Technical Analysis 101

Build the chart skills to use with GEX context

Learn how Gamma Exposure (GEX) reveals where SPX and SPY price will accelerate or stall. Understand liquidity shelves, gamma pockets, and dealer positioning.

This guide breaks down GEX in plain English so you can use it to improve your trades.

GEX (Gamma Exposure) measures the total gamma held by market makers at each strike price. Think of this chart as showing you where price moves freely vs. where it gets stuck.

Imagine price is a ball rolling on a surface. GEX shows you where the surface is smooth (ball rolls fast) vs. where there's friction (ball slows down). You want to know what's ahead before the ball gets there.

Market makers (the big players who provide liquidity) must hedge their options positions. This hedging creates mechanical flows that influence price action:

When there's a lot of options positioning at a strike, market makers must actively buy/sell shares to hedge. This creates friction that slows price down.

When there's minimal positioning, market makers don't need to hedge much. Price can move quickly with less resistance.

GEX isn't magic—it's showing you where the order flow from hedging will create natural support, resistance, or acceleration zones.

GEX is based on options open interest. For 0DTE trading, the current day's gamma levels are most relevant as contracts expire.

Red bars = price gets slowed down

Green bars = price can move faster

A GEX chart displays gamma exposure at each strike price. Here's how to interpret what you're seeing:

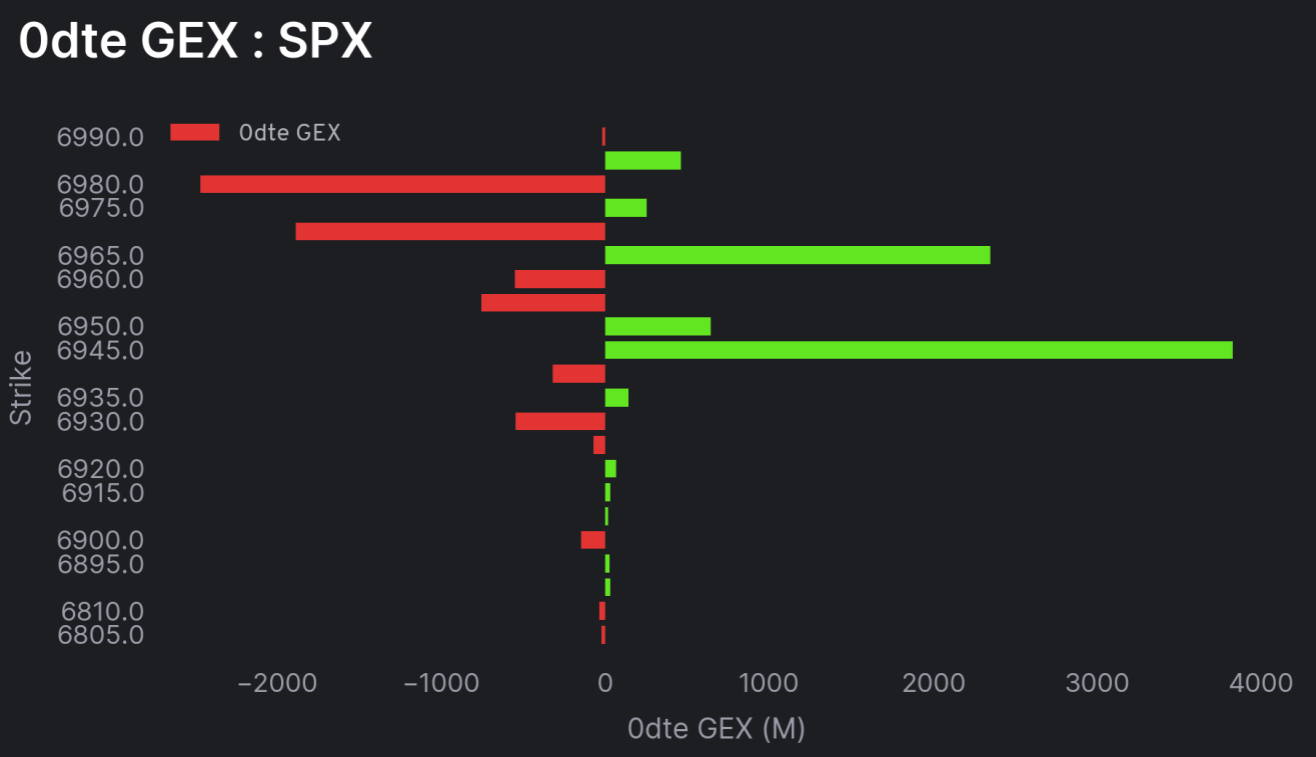

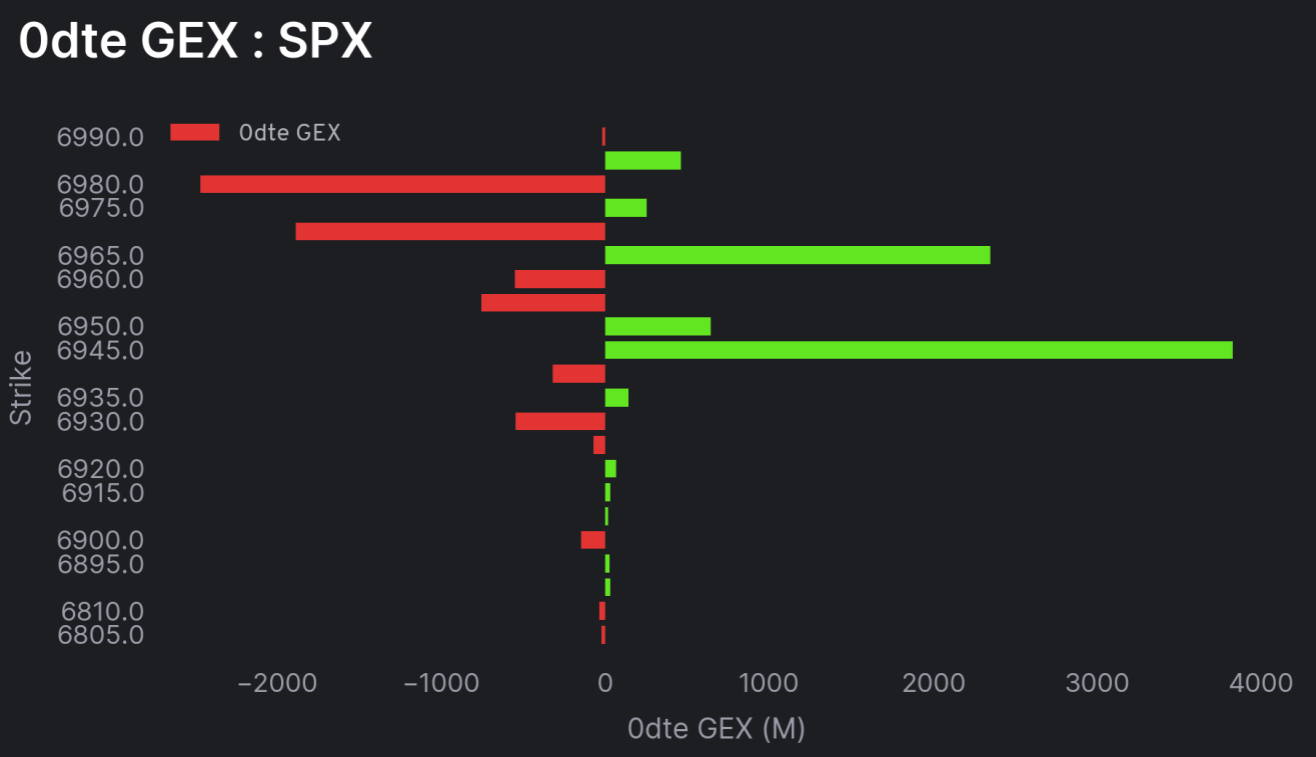

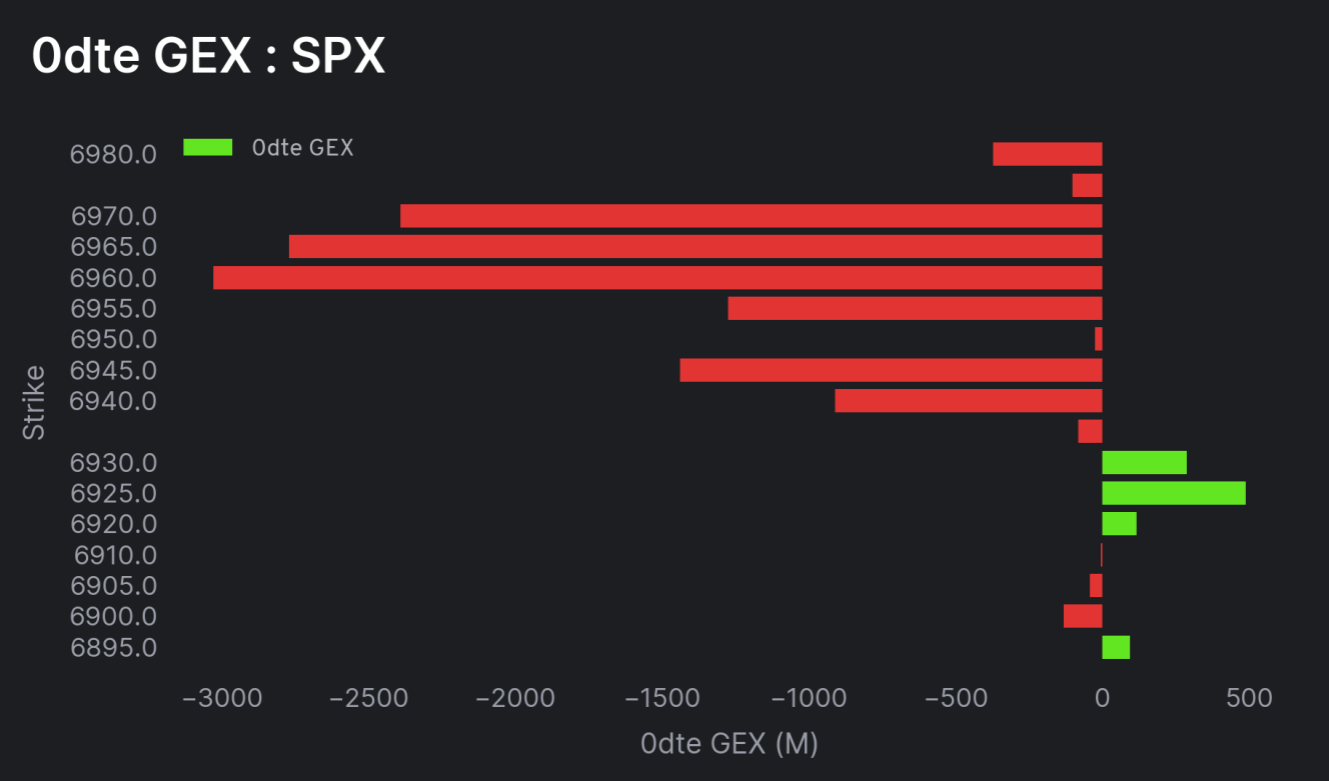

Example 0DTE GEX chart for SPX showing red (negative) and green (positive) gamma bars

The vertical axis shows SPX strike prices. Find where current price is, then look above and below to see what's waiting.

The horizontal axis shows the size of gamma exposure (in millions). Bigger bars = more hedging activity = more impact on price.

Focus on the clusters of large bars near current price. Distant strikes matter less for intraday trading.

A liquidity shelf is a price zone with significant negative gamma (big red bars). This is where market makers have heavy options positioning that requires active hedging.

Heavy options positioning at these strikes means market makers must hedge aggressively. This creates "friction" that resists price movement.

If price is approaching a liquidity shelf with momentum, expect it to stall or reverse—even if the move looked strong. Great for taking profits or fading moves.

If price is running toward a liquidity shelf and you're not already in the trade, don't chase. Wait for the reaction, then look for the next setup.

A gamma pocket is a price zone with minimal positioning (green bars or gaps in the chart). This is where market makers don't need to hedge much—so price can move fast.

Little to no options positioning means no hedging friction. Once price enters this zone, there's nothing slowing it down—moves can happen fast.

If price breaks into a gamma pocket, expect expansion—not mean reversion. Let winners run through pockets and don't take quick profits.

When price breaks through a liquidity shelf and enters a gamma pocket below, that's when puts can really move. The opposite works for calls breaking through support into a pocket above.

We don't trade just because of GEX. We trade from levels and use GEX to understand where price is likely to accelerate or get stuck.

GEX is a context tool, not a signal generator. Here's how to incorporate it into your process:

Start with your technical analysis—support, resistance, VWAP, moving averages, prior highs/lows. These are your trade levels.

Check the GEX chart to see what's at and around your levels:

Liquidity shelves → expect reactions or chop

Gamma pockets → expect speed and expansion

Our premium members get daily GEX levels, analysis, and real-time commentary on how price is interacting with gamma zones.

Use code ALPHA30 for 30% off Premium

Let's break down actual GEX charts so you can see these concepts in action:

Heavy negative gamma (red) creates "walls" while positive gamma or gaps (green) create "runways." Plan your trades accordingly—take profits at walls, let winners run through runways.

GEX for Beginners

Utilizing GEX with SPX

Industry standard for GEX data with detailed SPX and SPY gamma exposure analysis. They pioneered retail access to this data.

Options flow and gamma data with a clean interface. Has free tiers and social features for tracking whale activity.

While not GEX-specific, their community shares gamma indicators and scripts. Great for overlaying GEX levels on your charts.

We post daily GEX analysis in our free Discord with premium commentary for members.

Our free guide on options fundamentals, Greeks, and how gamma works at the contract level.

Trading psychology guide for managing emotions when trades don't go your way.

GEX (Gamma Exposure) measures the total gamma held by market makers at each strike price. It shows where dealers need to hedge their options positions, which directly impacts how price moves at different levels.

Red bars (negative gamma) indicate liquidity shelves where price tends to slow down, chop, or reverse. These are high-hedging zones where market makers need to actively manage their positions.

Green bars (positive gamma) indicate gamma pockets where price can move quickly with minimal resistance. These low-hedging zones allow for faster, more directional moves.

No. GEX is a context tool, not a trade signal. Use GEX to understand WHERE price is likely to accelerate or stall, then combine it with your technical levels and trade setups for entries.

A liquidity shelf is a price zone with significant red bars (negative gamma) where heavy options positioning requires market maker hedging. Price tends to stall, chop sideways, or reject at these levels.

A gamma pocket is a price zone with low or positive gamma (green bars or gaps in the chart) where little hedging is required. Once price enters these zones, moves can happen fast and extend quickly.

GEX data typically updates daily based on options open interest and positioning. For 0DTE trading, pay special attention to the current day's gamma levels as they're most relevant.

Join traders who use GEX context to improve their entries, exits, and expectations.

Less than one winning trade

Cancel anytime • Secure checkout via Whop

Just want to look around? Join free →