SPX PlaysBest Overall & Best Free Option

SPX Plays offers both a free community AND premium alerts—making it the best choice whether you're just starting out or ready for real-time trade alerts. The free Discord gives you access to market discussion, community support, and educational resources at zero cost.

The premium tier ($49/month) adds real-time SPX and SPY alerts with clear entries, scaling points, and exits. What sets it apart is the emphasis on position sizing over stop losses—a crucial concept for 0DTE trading that many communities ignore.

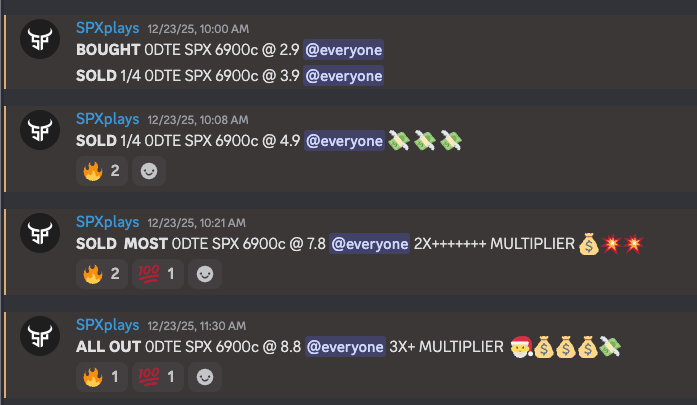

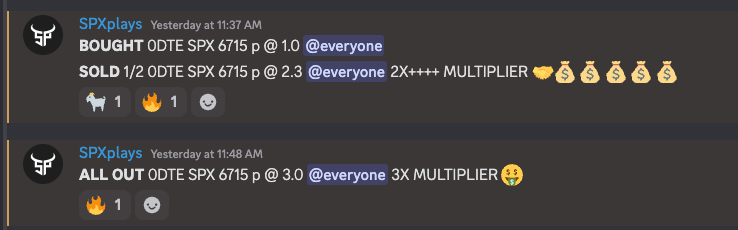

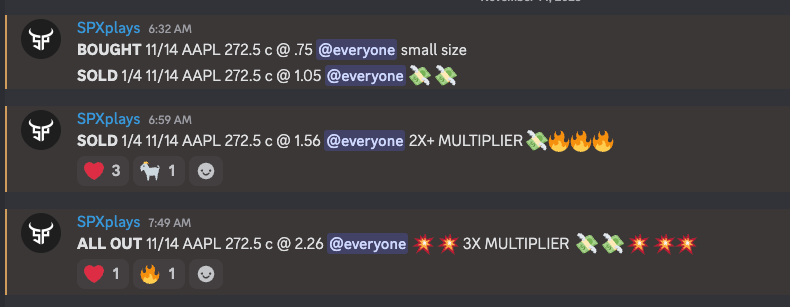

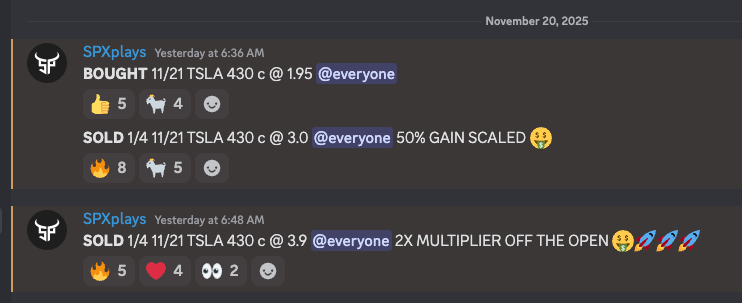

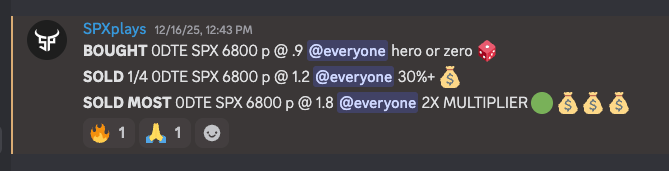

The community includes a full education hub covering options fundamentals and trading psychology. Recent track record shows consistent 2X-3X multipliers on plays, with honest communication about sizing ("small size," "hero or zero") that helps members manage risk appropriately.

📈 Recent Trade Results

SPX Plays

SPX Plays